I want to buy a house in Portugal, now what?

(Reading Time: 120s)

If you want to see the direct that we made about this publication, see here Chatting About I Want to Buy a House, and NOW?

If you want to see the direct that we made about this publication, see here Chatting About I Want to Buy a House, and NOW?

It is our objective to assist and accompany you in all the steps of the purchase of your property so that you can take the best decisions and find the house of your dreams.

The purchase of a house is an important moment for you, as it may be the biggest financial investment of your life.

Our aim is to make the process of purchasing a property more practical, safe and successful for future owners.

Before you start the process, it is very important that you ask yourself these questions:

Are you aware of the arduous task you have set yourself?

How have you determined the price you can pay for the property?

Do you have access to market values to be able to make a good deal?

How much time do you have available for all the paperwork?

Are you familiar with the documentation of a property?

Do you

know how to check if the property has mortgages or garnishments?

Can you assist the owner in obtaining the property's documentation?

Are you prepared to deal with all the bureaucratic process surrounding the purchase of your property?

If you answered "no" to any of the questions, feel free to schedule a clarification meeting with one of the consultants from our Team.

"Everything I dreamed of, started to happen when I decided to do it"

- AT

LET'S IDENTIFY THE VARIOUS STAGES OF THE PURCHASING PROCESS:

i. Financial Qualification;

ii. Qualification of the characteristics of the property and term of the purchase;

iii. Research and Visits;

iv. Proposal and Negotiation;

v. Banking Process;

vi. Promissory Contract of Purchase and Sale;

vii. Public Deed and Payment of taxes;

viii. What to do after the Deed?

i. Financial Qualification:

The first thing you should do when starting the process of buying a property, is to know how much you can afford.

After seeing the property of your dreams, above the value that you can afford, it will be much more difficult to find a smaller property in a less noble area.

A good financial qualification will help the process of visits and proposals to be faster. You will be much safer to make an offer and proceed to the signing of a Promissory Contract of Purchase and Sell.

At this stage, for us real estate consultants, after the financial qualification made with a specialist, we will only want to know 5 information:

1. What is the maximum value that you will be able to invest (value of the purchase of the property - expenses and taxes);

2. If you are going to resort to credit;

3. How much money you will have available as a down payment to sign a Promissory Contract Of Purchase and Sell;

4. If the credit is "Pre-approved" in the bank waiting for the property documentation to be sent to start the evaluation process.

5. If we find the property you want for a slightly higher price, can you make an additional effort?

"I didn't buy what I could, because I wanted to buy what I wasn't going to get" - AT

ii. Qualification of the property's characteristics and term of the purchase:

We will want to know exactly what you are buying. This is the only way we can stop presenting you with properties that don't meet your interests / needs / expectations.

At this stage it will be very important to talk to you. Our procedure is to hold a meeting where we will identify 6 information:

1. Characteristics that the property must have;

2. Features of the property that, although you do not need it, you would like it to have;

3. Area where you want to buy;

4. Area where you could live if we can't find what you want in the first area;

5. By what date will you have to buy the property;

6. What are the consequences if you do not buy the property by the date set out in the previous point.

"I visualised what I wanted... when I saw it I realised it was the one" - AT

iii. Surveys and Visits:

At this stage we have already started the research process. We will be actively searching for your property.

We will only present you with properties that are within the qualifications we have made.

It is normal in this phase, the buyer collaborates in the research. Send us all the properties you find so we can validate if it fits within your requirements.

Be prepared at this stage to make an offer on the first property you find.

It is common for a buyer to say: "I'm not going to buy the first house I see". This buyer may have just missed the first best deal.

"The Property I saw today and liked, and will still think about, another client saw yesterday... and has already thought about" - AT

iv. Proposal and Negotiation:

We have already found the property that fits within what you need and can afford. Let's start negotiating.

At this stage we will give you the information you need to make an honest offer.

Decide on the maximum amount you will pay for the property and let us negotiate.

For an offer, it is not only the value that counts, but also:

- What is the deadline for signing the PSPC?

- Will you make the proposal conditional on evaluation?

- What is the amount of the deposit to be paid?

- What is the deadline for the deed?

"Business flows when it is good for both sides" - AT

v. Banking process:

This process may take place before or after the PSPC. It will depend on the conditions we manage to negotiate the proposal.

At this stage we will send the property documents to the bank. It is likely that the bank will now debit you the valuation of the property.

If all the process in the bank is ready, after sending the documentation of the property, it is expectable that the bank schedules the evaluation up to 48 hours and informs you the value of the evaluation in 72 hours.

In the case of having signed a PSPC with a resolutive clause, after leaving the favourable evaluation of the property, we should inform the selling party that the process is closed and that we will wait for the schedule of the deed.

After the evaluation is issued, the credit approval letters are issued, which will be signed and we will wait for the mandatory period of 7 days for reflection.

vi. Promissory Contract of Purchase and Sale:

This document provides to set out the terms of the business of buying and selling an agreed property.

It is signed by the parties involved in the business representing the promissory seller and buyer.

The parties can be replaced by a representative with a valid power of attorney for the act.

See here all the information about the Promissory Contract for Sale and Purchase.

vii. Public Deed and Payment of Taxes:

The Public Deed is a definitive contract of sale and purchase.

When the client is able to do so, he can, after the proposal is accepted, "go straight" to deed. Although it is possible, we always advise signing a PSPC so that we have time to receive and check all the documentation. A PSPC we may be able to sign in less than 24 hours, however a deed becomes more complicated.

Before signing the final contract, you will have to pay the taxes.

Here are all the steps you should take after celebrating the deed.

TIPS FROM ATrindade Team:

- Don't make a visit to a property that you are not sure you can afford to buy;

Transforming the transaction of a property into a rewarding experience.It is our goal that, regardless of the motivations of the transaction, the final emotion is always positive, promoting repeat business.To add value to the client's situation and thus make the purchase or sale of the property a positive experience.

LET'S WORK AS A TEAM!

| |

Download our Interactive Buyer's Dossier here:

If you are thinking of SELLING or BUYING, talk to our team

so we can help you find out if the best time is NOW!

Com o objetivo de num evento solidário juntar os amantes de motas, a Equipa ATrindade através do seu projeto de Responsabilidade Social, em com a colaboração de diversas empresas e entidades, promove a "Bênção dos Capacetes" OBJETIVO PRINCIPAL DO EVENTO: Dinamizar a “Bênção dos capacetes” das pessoas que gostem e tenham respeito pelas motas independentemente do tamanho, marca ou tipo de mota; OUTROS OBJETIVOS: Dar a conhecer o Concelho de Resende aos participantes; Repetir o evento anualmente; Mudar anualmente a associação e/ou causa para a qual se destinam os donativos; Todos os anos mudar os locais de encontro e “Bênção dos capacetes” por forma a dinamizar e dar a conhecer outros locais. AGENDA: 9:00 - Início da receção "dos Capacetes" e motas Em S. Cipriano 10:30 - Arranque da caravana com passeio em direção ao centro da Vila de Resende 13:00 - Bênção dos Capacetes no Centro da Vila de Resende ALMOÇO: Aos participantes, oferta da Junta de Freguesia de Resende, será servido um "pequeno lanche" no final da Bênção no Centro da Vila. Os participantes que pretendam um almoço reforçado, podem fazer de forma livre podendo de vários locais diferentes no Concelho de Resende. Oportunamente iremos identificar alguns restaurantes e locais que se irão associar ao evento. LIGUE-SE AO EVENTO: Este programa poderá ser adaptado e atualizado. Sigam o evento aqui e no facebook para se manterem atualizados. Se for participar no evento, deverá entrar no grupo do whatsapp criado para o efeito onde irá receber também a informações importantes antes e principalmente durante o evento. Clique aqui para entrar no grupo. INSCRIÇÕES: O evento é solidário, sem qualquer custo de inscrição, onde apenas serão recolhidos donativos que revertem integralmente para as seguintes Associações / Instituições: - Casa do Povo de Resende - Irmandade São Francisco Xavier - Santa Casa da Misericórdia e Resende - Portas P´rá Vida - A2000 Se vai participar entre no grupo do whatsapp clicando aqui Vamos Sensibilizar para o desporto Sénior com a Prática de Boccia Como não haverá inscri ções, durante a preparação e no decorrer do evento serão recolhidos donativos que serão integralmente para comprar equipamento de Boccia a entregar às associações que apoiam séniores no Concelho de Resende. Após o evento iremos dar conhecimento dos valores recolhidos bem como informar quantos familiares e/ou cuidadores vão poder ser acompanhados com os donativos recolhidos. No Grupo do Facebook poderá acompanhar todo o processo. Se vai participar no evento entre no nosso grupo do whatsapp Siga aqui o evento no facebook ATrindade & Friends , Fazemos Muito Quando Todos Fazemos um Pouco!

O Que é o Distrate?

O distrate é um documento emitido pelo banco que comprova o cancelamento de uma hipoteca sobre um imóvel. Ou seja, quando um vendedor tem um crédito habitação associado ao imóvel e deseja vendê-lo, é necessário obter o distrate para confirmar que a dívida foi liquidada e que a hipoteca pode ser removida do registo da propriedade.

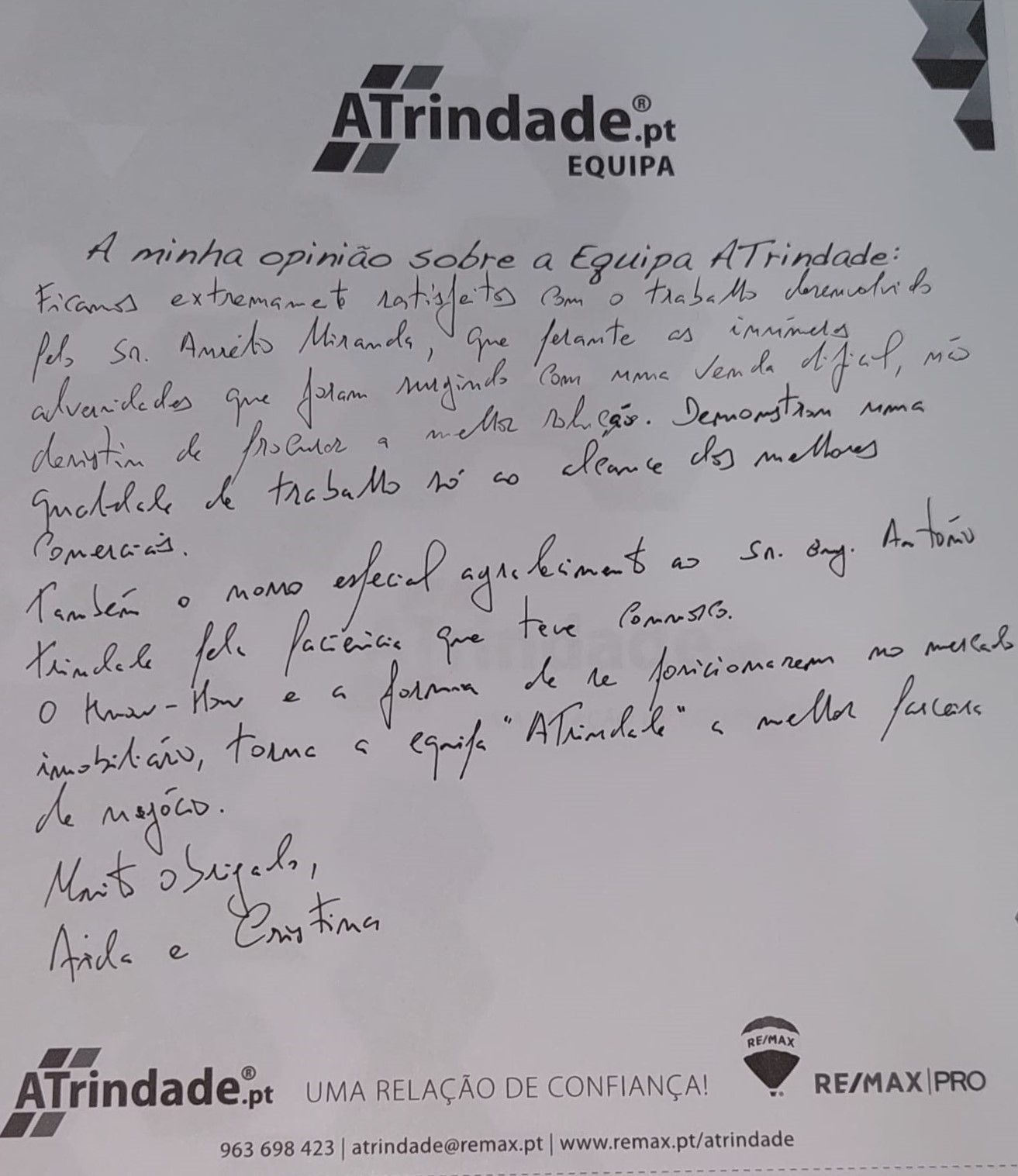

"Ficamos extremamente satisfeitas com o trabalho desenvolvido pelo Sr. Aurélio Miranda, que perante inúmeras adversidades que foram surgindo com a venda difícil, não desistiu de procurar a melhor solução. Demostrou uma qualidade de trabalho só ao alcance dos melhores comerciais. Também o nosso agradecimento ao Sr. Eng. António Trindade pela paciência que teve connosco. O Know-How e a forma de se posicionarem no mercado imobiliário, torna a Equipa ATrindade a melhor parceria de negócio. Muito Obrigado, Aida e Cristina" Proprietárias de Prédio em S. Mamede que confiou na ATrindade Consultores a promoção e venda do seu imóvel

O isolamento térmico de um imóvel é um dos fatores mais relevantes, não só para garantir o conforto de quem lá vive, mas também para valorizar a propriedade no mercado. Num contexto onde a eficiência energética e a sustentabilidade estão no topo das prioridades dos compradores, entender o valor de um bom isolamento térmico pode ser determinante para quem deseja vender ou comprar um imóvel.