What is the Promissory Contract of Sale and Purchase - CPCV?

This document, although not mandatory, is important because it will guarantee the rights and duties of those involved in the business.

This document is identified as the Promissory Contract of Sale and Purchase. For short, we will identify this document as "CPCV".

WHAT IS THE PROMISSORY CONTRACT OF SALE AND PURCHASE - CPCV?

It is a document that establishes the business conditions of the purchase and sale of an agreed property.

Signed by the parties involved in the business representing the promissory seller and buyer.

The partners can be substituted by a representative with a valid power of attorney for the act.

WHAT SHOULD THE CPCV CONTAIN?

Identification of the intervening parties, vendor and purchaser, which must contain the full name, place of birth, address, marital status, identification card number and fiscal number;

Identification of the property, with reference to the Land Registry, Permanent Land Registry Certificate, Utilization License, Energy Certificate;

Characteristics of the property, such as address, typology, if it has or not other parties integral to the fraction, such as swimming pool, garage or storage room;

Mention that the property will be sold free of any liens and encumbrances;

Mention that the dwelling is in habitable condition, with all that this implies, namely: the internal networks and water, electricity, sewage and gas installations and that they are in working order

Mention that the buyer knows the state of the property;

Deadline for the execution of the definitive purchase and sale contract (public deed);

Consequences for the non fulfilment of the term or assumptions of the contract;

Value of the sale;

Value and form of payment of the down payment (this value is usually between 10 and 20% of the total value, any other value may be agreed between the parts);

Mention of the company that did the real estate mediation (if this is the case).

IN WHAT SITUATIONS SHOULD A CPCV BE SIGNED?

- Whenever the conditions for the definitive purchase and sale contract (public deed) are not yet fulfilled, such as:

- The original use license is missing;

- The Energy Certificate is still being issued;

- The Land Registry and the Permanent Land Certificate are not harmonized;

- The property is still under construction;

- The Owner cannot deliver the property immediately;

- The buyer is going to resort to bank financing that needs approval (in this case the CPCV must contain a resolutive clause).

WHAT ARE THE CONSEQUENCES IN THE EVENT OF NON-COMPLIANCE:

- For the buyer - loses the right to all the values already paid as a down payment;

- By the seller - has to return to the buyer the double of the value of the deposit paid;

- In any of the situations, the party that did not comply, can appeal to the court to request the specific execution of the contract, with the objective of, in a court sentence, achieving the coercive fulfilment of the CPCV.

TIPS FROM THE ATrindade Team:

- The owner should submit the last minutes of the condominium meetings. In these documents it is possible to verify if there are works to be done or planned, as well as other situations that have occurred in the condominium;

- In the CPCV make reference to the number of the cheque used for the payment of the deposit. Or in alternative identify the IBAN of the bank accounts where the deposit will come from and where it will go to;

- If you have already decided on the purchase or sale of the property, don't delay signing the CPCV.

Don't forget to see the necessary documents for the sale of the property

If you are thinking of SELLING or BUYING, talk to our Team

so we can help you find out if the best time is NOW!

Com o objetivo de num evento solidário juntar os amantes de motas, a Equipa ATrindade através do seu projeto de Responsabilidade Social, em com a colaboração de diversas empresas e entidades, promove a "Bênção dos Capacetes" OBJETIVO PRINCIPAL DO EVENTO: Dinamizar a “Bênção dos capacetes” das pessoas que gostem e tenham respeito pelas motas independentemente do tamanho, marca ou tipo de mota; OUTROS OBJETIVOS: Dar a conhecer o Concelho de Resende aos participantes; Repetir o evento anualmente; Mudar anualmente a associação e/ou causa para a qual se destinam os donativos; Todos os anos mudar os locais de encontro e “Bênção dos capacetes” por forma a dinamizar e dar a conhecer outros locais. AGENDA: 9:00 - Início da receção "dos Capacetes" e motas Em S. Cipriano 10:30 - Arranque da caravana com passeio em direção ao centro da Vila de Resende 13:00 - Bênção dos Capacetes no Centro da Vila de Resende ALMOÇO: Aos participantes, oferta da Junta de Freguesia de Resende, será servido um "pequeno lanche" no final da Bênção no Centro da Vila. Os participantes que pretendam um almoço reforçado, podem fazer de forma livre podendo de vários locais diferentes no Concelho de Resende. Oportunamente iremos identificar alguns restaurantes e locais que se irão associar ao evento. LIGUE-SE AO EVENTO: Este programa poderá ser adaptado e atualizado. Sigam o evento aqui e no facebook para se manterem atualizados. Se for participar no evento, deverá entrar no grupo do whatsapp criado para o efeito onde irá receber também a informações importantes antes e principalmente durante o evento. Clique aqui para entrar no grupo. INSCRIÇÕES: O evento é solidário, sem qualquer custo de inscrição, onde apenas serão recolhidos donativos que revertem integralmente para as seguintes Associações / Instituições: - Casa do Povo de Resende - Irmandade São Francisco Xavier - Santa Casa da Misericórdia e Resende - Portas P´rá Vida - A2000 Se vai participar entre no grupo do whatsapp clicando aqui Vamos Sensibilizar para o desporto Sénior com a Prática de Boccia Como não haverá inscri ções, durante a preparação e no decorrer do evento serão recolhidos donativos que serão integralmente para comprar equipamento de Boccia a entregar às associações que apoiam séniores no Concelho de Resende. Após o evento iremos dar conhecimento dos valores recolhidos bem como informar quantos familiares e/ou cuidadores vão poder ser acompanhados com os donativos recolhidos. No Grupo do Facebook poderá acompanhar todo o processo. Se vai participar no evento entre no nosso grupo do whatsapp Siga aqui o evento no facebook ATrindade & Friends , Fazemos Muito Quando Todos Fazemos um Pouco!

O Que é o Distrate?

O distrate é um documento emitido pelo banco que comprova o cancelamento de uma hipoteca sobre um imóvel. Ou seja, quando um vendedor tem um crédito habitação associado ao imóvel e deseja vendê-lo, é necessário obter o distrate para confirmar que a dívida foi liquidada e que a hipoteca pode ser removida do registo da propriedade.

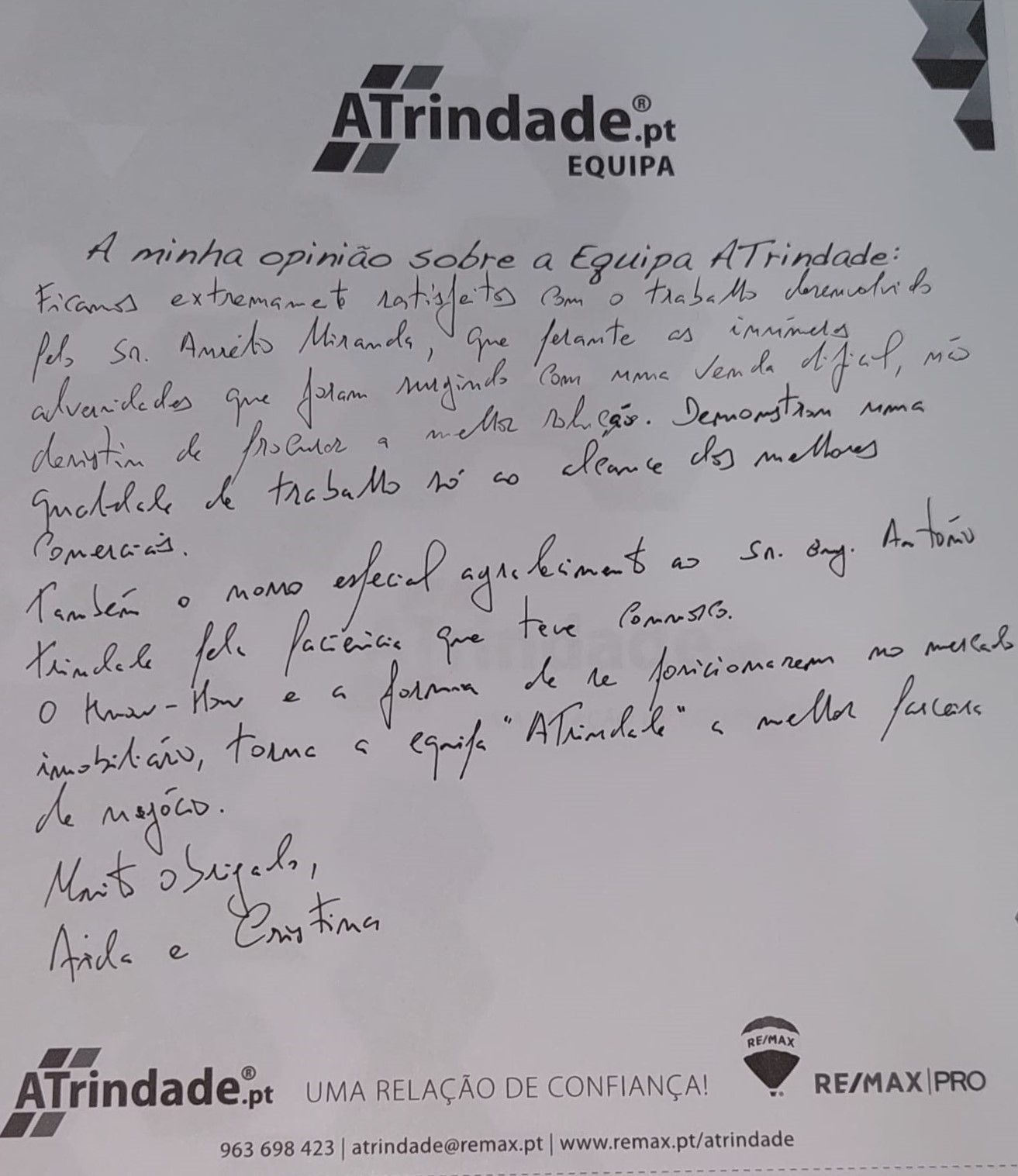

"Ficamos extremamente satisfeitas com o trabalho desenvolvido pelo Sr. Aurélio Miranda, que perante inúmeras adversidades que foram surgindo com a venda difícil, não desistiu de procurar a melhor solução. Demostrou uma qualidade de trabalho só ao alcance dos melhores comerciais. Também o nosso agradecimento ao Sr. Eng. António Trindade pela paciência que teve connosco. O Know-How e a forma de se posicionarem no mercado imobiliário, torna a Equipa ATrindade a melhor parceria de negócio. Muito Obrigado, Aida e Cristina" Proprietárias de Prédio em S. Mamede que confiou na ATrindade Consultores a promoção e venda do seu imóvel

O isolamento térmico de um imóvel é um dos fatores mais relevantes, não só para garantir o conforto de quem lá vive, mas também para valorizar a propriedade no mercado. Num contexto onde a eficiência energética e a sustentabilidade estão no topo das prioridades dos compradores, entender o valor de um bom isolamento térmico pode ser determinante para quem deseja vender ou comprar um imóvel.